I’ll start with a personal anecdote. Back in February/March of 2022, I was thinking of buying a home. I quit due to a combination of high prices and my only good prospect of a reasonable deal falling through, but not before I had a disturbing conversation with the family member of a friend. This family-of-a-friend works at $BigTechCompany. She assumed that my lack of success at buying a house was due to insufficient funds rather than a lack of willingness on my part to pay what I saw as high prices. So she decided to give me a bit of advice.

You work at $OtherBigTechCompany. Can’t you take out a margin loan?

I looked confused.

You know… A loan against your $OtherBigTechCompany stocks, so that you don’t have to have a bigger downpayment for a mortgage. I’ve done it with my $BigTechCompany stocks.

I smiled and nodded and thanked her for the advice, but internally I thought this was a bit odd. My favorite movie in the entire world is The Big Short and the entire subject is exotic financial instruments and their role in the housing bubble.

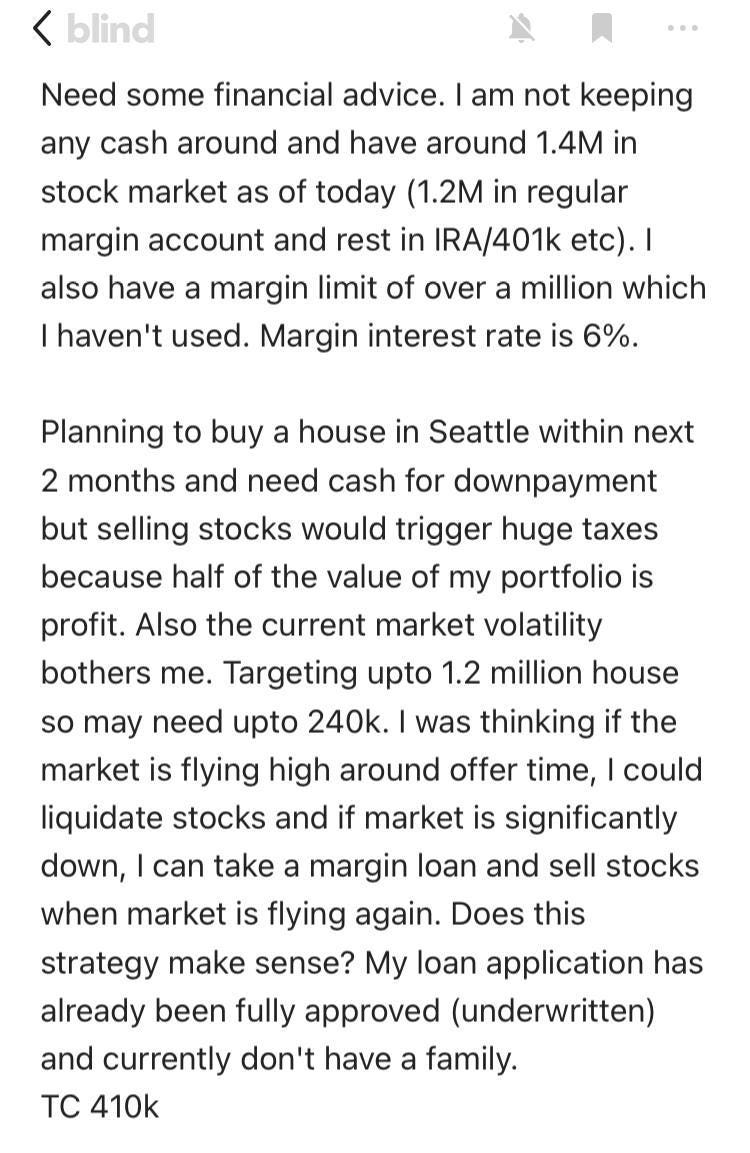

I put it entirely out of my mind until today, when I saw the most ridiculous post on Reddit:

Whoa.

I dug around a bit and found this Forbes article:

Most of us understand how getting a mortgage can help us purchase a property. We use our personal funds (usually 20% of the purchase price) as a down payment and then obtain a mortgage from a bank or financial institution for the remaining 80% of the purchase price. The mortgage rate is based on current interest rate levels. There are fixed-rate loans for 10, 15 or 30 years, or you may choose an interest-only loan with a floating rate that can start low and adapt to interest rates. It can increase if interest rates go up and decrease if interest rates go down.

Buying on margin allows an investor to make a down payment or buy a home using securities in their investment account as collateral. They are leveraging the securities that they own to get the cash they need. Using a margin loan is borrowing money. This means interest will be charged monthly to your account until you pay off the loan.

When assets appreciate, you can make payments toward the margin loan. Brokerage firms and custodians will determine the margin loan interest based on the amount of assets you have with them, with larger accounts charged lower rates.

Margin accounts require the value of the portfolio to be kept at a certain percentage of marginable assets. Investment firms generally allow loans of up to 50% of the current value of the portfolio. Not all assets qualify to be bought on margin. The Fed (Federal Reserve Board) regulates which stocks are marginable. Generally, all domestic bonds and listed company stocks are marginable.

Your margin loan amount will be based on the value of the assets in your account. However, markets—especially stocks—fluctuate in value. A market drop may cause a loss in the value of the securities in the account. If the account drops below a certain percentage, a margin call will be issued. You will then have to increase the amount of collateral in the margin account. This is done by adding cash or more marginable assets to the portfolio. The amount added will have to bring the account value back to the required percentage to maintain the margin loan. The custodian of your investment account is allowed to sell securities to bring the account back to the minimum amount of collateral required.

Now, I’d heard of this before. I have long been wanting Tesla’s Elon Musk to get margin called on some of the zillions of dollars of loans he’s taken out against his Tesla stock, especially in light of his latest attempt to use these loans to buy Twitter. But I thought that this was only a thing that rich people did. Risk, of course, looks very different if you’re extroardinarily wealthy. Things like only buying high-deductible health insurance, which would be wild to do if you were middle-class, start to make sense when you’re wealthy.

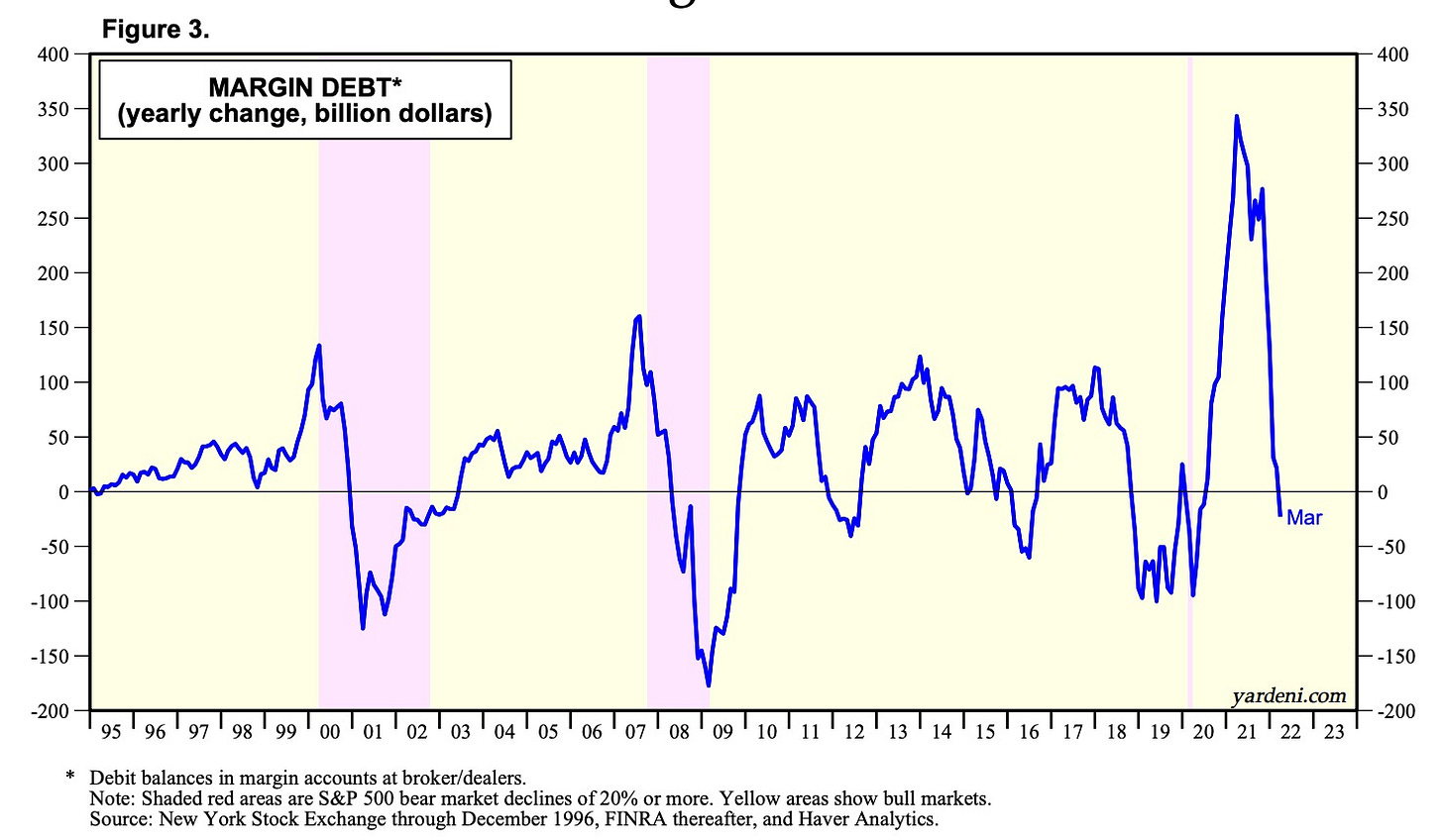

Of course, just like in The Big Short, tons of normies using margin loans could introduce a lot of systemic risk. If lots of people have tech stock (check), and lots of people are buying houses (check), and a lot of those people are the tech-stock-owners using their tech stocks as collateral to buy those houses… well they could all get margin called at once if tech stocks dropped, forcing them to sell tech stocks to cover their margins, which would cause tech stocks to crash more, which would cause even more people to get margin called…. in a vicious downward spiral which would cause a simultaneous tech stock crash AND a housing market crash. Like 2008 and the Dotcom Bubble combined.

As someone who enjoys chaos and schadenfreude, I’m really happy with this thought.

So…. how many people are taking out these margin loans?

My partner has found a lot of these (and similar) goodies while digging around on Blind, which is like an anonymous Reddit where tech industry a-holes go to bitch and moan.

Yessssss….. do it you absolute dumbass….

YESSSSSS….

HAHAHAHAHA YOU SUCKER!!!

(And before anyone says I’m being a ghoul: I would like to remind you that this goofball is making $410k/year. I won’t apologize for being unsympathetic about their bad, tax-dodging financial choices.)

So, are we going to see absolute dotcomplus2008 calamity? I’m not sure. I suspect it will be confined to the utter devestation of obnoxious techbros. But I can’t be sure. I won’t break out the champagne just yet.